Recognizing the Relevance of Bid Bonds in Construction Projects

Recognizing the Relevance of Bid Bonds in Construction Projects

Blog Article

Crucial Steps to Get and Use Bid Bonds Successfully

Browsing the complexities of bid bonds can dramatically affect your success in securing contracts. The genuine difficulty lies in the meticulous choice of a reliable company and the strategic application of the bid bond to boost your affordable edge.

Comprehending Bid Bonds

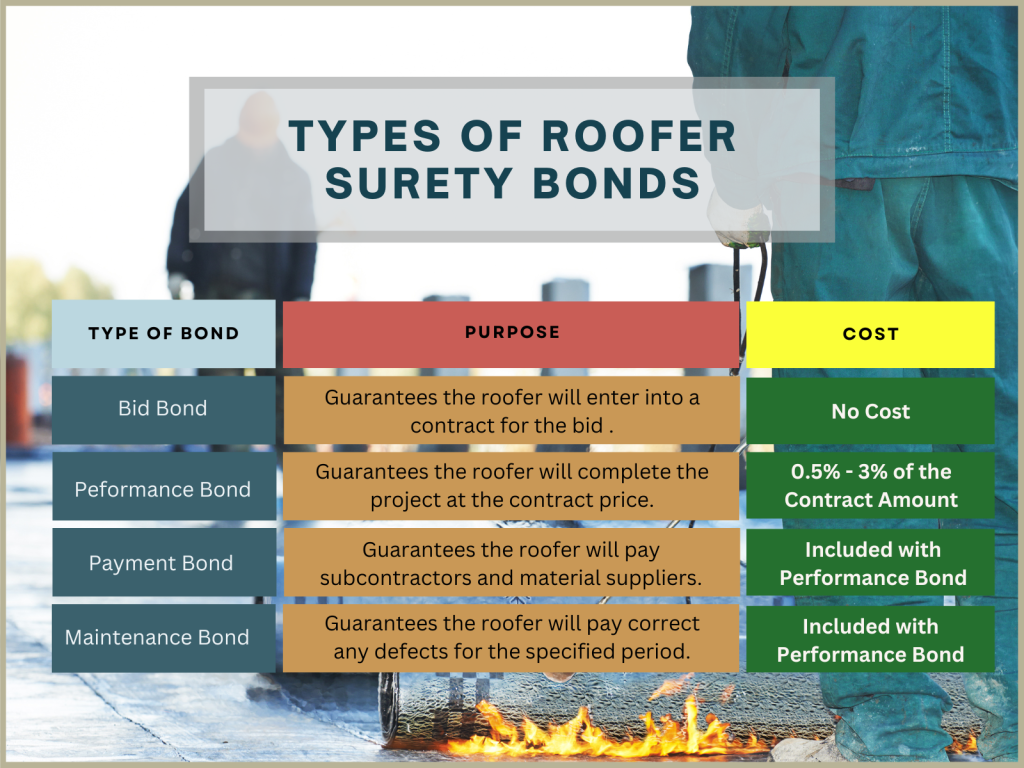

Quote bonds are an important element in the construction and having sector, working as a monetary assurance that a bidder intends to participate in the agreement at the bid price if granted. Bid Bonds. These bonds reduce the danger for project owners, making sure that the picked professional will certainly not just recognize the bid yet likewise safe performance and payment bonds as needed

Essentially, a proposal bond serves as a protect, shielding the task owner versus the economic effects of a specialist withdrawing a quote or failing to begin the task after choice. Typically issued by a surety company, the bond guarantees compensation to the proprietor, typically 5-20% of the proposal quantity, should the specialist default.

In this context, proposal bonds cultivate an extra trustworthy and affordable bidding process environment. Quote bonds play a crucial function in keeping the integrity and smooth operation of the building and construction bidding process.

Getting Ready For the Application

When preparing for the application of a quote bond, precise company and complete documents are paramount. A comprehensive testimonial of the project specs and bid needs is vital to ensure compliance with all specifications. Begin by putting together all needed economic statements, including annual report, income statements, and cash circulation declarations, to demonstrate your business's monetary health and wellness. These files need to be existing and prepared by a certified accountant to improve reliability.

Next, compile a checklist of past tasks, specifically those comparable in scope and size, highlighting effective conclusions and any awards or accreditations got. This plan supplies an all natural sight of your company's technique to task execution.

Guarantee that your organization licenses and registrations are updated and readily available. Having actually these documents organized not just quickens the application procedure however also forecasts a specialist image, instilling self-confidence in possible guaranty service providers and project proprietors - Bid Bonds. By systematically preparing these aspects, you position your company positively for successful quote bond applications

Finding a Surety Provider

A surety business familiar with your area will better recognize the special risks and needs linked with your projects. It is likewise advisable to assess their monetary scores from agencies like A.M. Best or Requirement & Poor's, ensuring they have the financial toughness to back their bonds.

Involve with several companies my website to contrast solutions, terms, and rates. A competitive assessment will certainly help you secure the best terms for your proposal bond. Ultimately, a complete vetting procedure will certainly make certain a reliable collaboration, cultivating self-confidence in your bids and future jobs.

Submitting the Application

Sending the application for a proposal bond is a crucial step that requires precise interest to information. This process starts by collecting all appropriate documentation, consisting of economic statements, task specs, and an in-depth organization background. Guaranteeing the accuracy and efficiency of these records is extremely important, as any kind of discrepancies can result in beings rejected or delays.

When filling up out the application, it is a good idea to ascertain all entrances for accuracy. This consists of verifying figures, making sure correct trademarks, and confirming that all needed add-ons are consisted of. Any omissions or mistakes can undermine your application, causing unneeded difficulties.

Leveraging Your Bid Bond

Leveraging your quote bond successfully can dramatically improve your competitive edge in protecting contracts. A proposal bond not only shows your economic security yet additionally reassures the project owner of your commitment to satisfying the contract terms. By showcasing your proposal bond, you can underline your company's dependability and integrity, making your quote stick out among many competitors.

To take advantage of your proposal bond to its greatest potential, guarantee it exists as part of a comprehensive quote plan. Highlight the strength of your surety company, as this mirrors your firm's financial wellness and operational ability. Additionally, highlighting your record of successfully completed jobs can additionally infuse confidence in the job owner.

Furthermore, keeping close interaction with your guaranty company can help with much better conditions in click future bonds, thus enhancing your competitive placing. A positive method to handling and restoring your bid see this site bonds can likewise prevent lapses and make certain continuous protection, which is essential for ongoing project purchase initiatives.

Final Thought

Effectively making use of and getting proposal bonds necessitates detailed preparation and strategic execution. By thoroughly organizing key documentation, choosing a reputable guaranty provider, and sending a full application, companies can protect the necessary proposal bonds to improve their competition.

Determining a respectable guaranty company is a critical step in securing a proposal bond. A bid bond not only shows your financial stability however also reassures the task proprietor of your dedication to fulfilling the agreement terms. Bid Bonds. By showcasing your proposal bond, you can highlight your company's dependability and reliability, making your proposal stand out among various rivals

To take advantage of your proposal bond to its greatest potential, ensure it is provided as component of a comprehensive proposal plan. By adequately arranging key paperwork, selecting a trustworthy guaranty copyright, and submitting a complete application, firms can safeguard the necessary bid bonds to enhance their competitiveness.

Report this page